Blockchains - Risk, Lies, and Hype

Index of all Chipkin blockchain articles : Index

By: Peter Chipkin

Table of Contents

Part 1 - Risks

- Forking

- Supply and Demand

- Control of the Nodes / Ledgers

- Honoring Contracts

- Lack of Central Control

- Inflation

- The Ledger Risk

- No Name Brands – Who are you trusting ?

Part 2 - Lies and Hype - Don't Believe Everything you Read.

- How Bitcoins will end world poverty

- ICO Initial Coin Offerings

- Reasons To Be Skeptical

- Don't Trust Anyone

- Amazon better watch out

- Centralized institutions will fall

- Blockchains – $300m lost due to bug

Part 1 - Risks

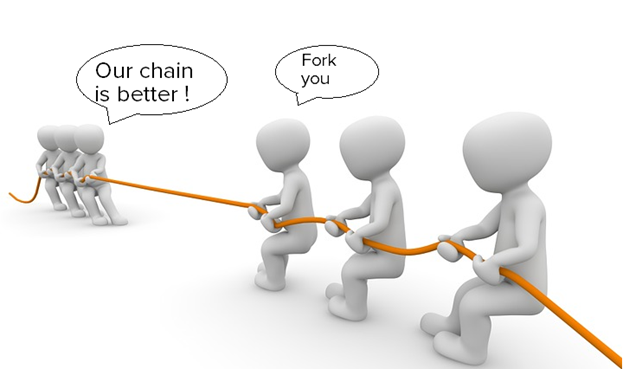

Forking

A fork is what happens when a blockchain diverges into two potential paths forward — either with regard to a network's transaction history or a new rule in deciding what makes a transaction valid.

Some forks resolve on their own, but others, fueled by deep rifts in a community, can cause a network to permanently split, creating two blockchain histories — and two separate currencies.

- Hard Fork – Not backward compatible

- Soft Fork – Backward compatible

When a Fork occurs the value of the contents of the blockchain eg bitcoins are not lost. They end up duplicated and exist on both blockchains. If you have a bit coin before a fork you end up with 2 after the fork. One of the original and one of the new. The value of each is dependent on the popularity of the fork. If community abandon the old blockchain or if the new block chain never becomes popular then the value of the bitcoins will suffer.

Any node can choose to join/leave any of the forked blockchains. Its their choice.

Supply and Demand

Price and value is based on supply and demand. If there is no demand for a blockchain then no one will be mining it, new blocks wont get added and that chain will decrease in value. When there are too few miners the blockchain can be attacked and hijacked.

If miners can't make money they will abandon the blockchain. They only do it for money.

Perhaps its better to go IBM and Microsoft and launch your application on a more predictable instance of the blockchain.

Control of the Nodes / Ledgers

Someone controlling a majority of network hash rate may have the ability to revise transaction history and prevent new transactions from confirming.

By controlling the majority of the computing power on the network:

- An attacker or group of attackers can interfere with the process of recording new blocks.

- They can prevent other miners from completing blocks, theoretically allowing them to monopolize the mining of new blocks and earn all of the rewards (for bitcoin, the reward is currently 12.5 newly-created bitcoins, though it will eventually drop to zero). They can block other users' transactions.

- They can send a transaction, then reverse it, making it appear as though they still had the coin they just spent. This vulnerability, known as double-spending, is the basic cryptographic hurdle the blockchain was built to overcome, so a network that allowed for double-spending would quickly suffer a loss of confidence

A 51% attack is a potential attack on the bitcoin network whereby an organization is somehow able to control the majority of the network mining power (hashrate). Bitcoin is secured by having all miners (computers processing the networks transactions) agree on a shared ledger called the blockchain. Bitcoin nodes look to each other to verify what they're working on is the valid blockchain. If the majority of miners are controlled by a single entity, they would have the power to (at least attempt to) decide which transactions get approved or not. This would allow them to prevent other transactions, and allow their own coins to be spent multiple times - a process called double spending.

Honoring Contracts

'Smart Contracts' is the name given to executable programs that live inside a blockchain and which will execute autonomously if the trigger conditions (also in the chain) are met.

In the Ethereum blockchain the executability is built into the blockchain itself so it would seem like you are safe BUT that is not true.

- If a Smart Contract is dependent on the api / interface to another system then there is no guarantee that other system will be present and functional when the contract tries to execute.

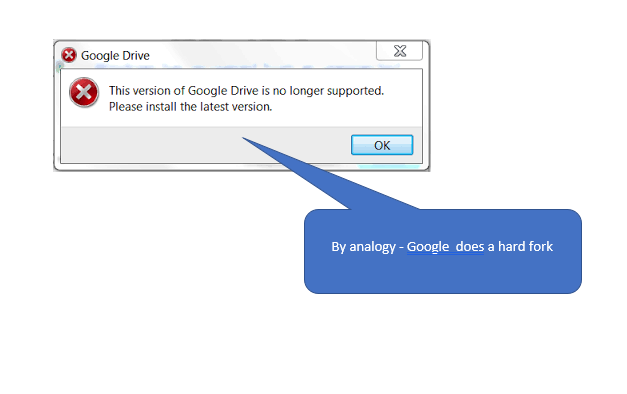

- Hard Forks of the blockchain may choose to abandon functionality that was supported in the past. While the function may live on in one of the forks – that fork may cease to exist or have an effective set of distributed nodes.

Lack of Central Control

- There is no-one to enforce the promises made.

- There is no-one to force essential and good improvements.

- There is no-one to stop forking of these open-source type projects.

- There is no contingency planning or preparation for disasters.

- There is no-one to sue for losses.

- When you use vendor deployed block chains from companies like IBM, Intel you are subject to their commercials interests. So even though some of the problems from lack of authority are solved you may find features and services depreciated.

Inflation

You design an application which uses a blockchain but the cost of adding blocks and doing transactions is outside your control.

I know you would not do this but the example is illustrative. You can insert small data strings in the bitcoin blockchain but you have to pay with bitcoins to do this. The cost of a bitcoin has gone up by thousands of percent. So what cost a few pennies a year ago could cost you hundreds of dollars today.

Same applies to Smart Contracts.

The Ledger Risk

If there are 20,000 replicated ledgers then we feel safe because they are all identical. That's the point isn't it?

Who says they are identical?

Don't let anyone blow you off with this "If a ledger does not match then the consensus protocol will not accept its blocks. So it doesn't matter.

It can matter. Its theoretically possible that you have been duped and that all your transactions only occurred on the invalid ledger – effectively you are working on a fork and your transactions may be value-less. This could only happen if the software you are using comes from complete crooks.

No Name Brands – Who are you Trusting?

Software and resource providers for block chains are not trusted and regulated institutions. Your bit coin is only as safe as your primary key is safe. Do you know anything about the company you are giving your key to. Eg. Kaspersky Anti-Virus protects your PC but sends data to Russian Intelligence.

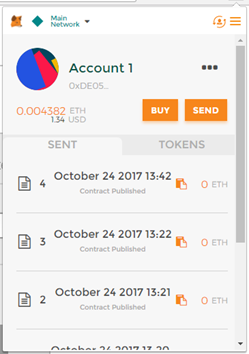

This is a screenshot of the popular MetaMask Wallet. It looks like it was written by a hacker in a basement in 5 minutes. Perhaps it was. Perhaps it has security flaws. Perhaps it has deliberate flaws.

If you work with Bitcoins, Ethereum and other block chains you will be working with software from startups and other unreliable sources.

You will assume that because others are using the same software that it is safe. You may regret that assumption.

Part 2 - Lies and Hype - Don't Believe Everything you Read

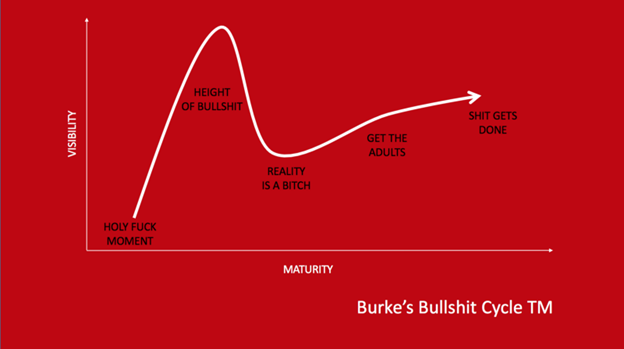

Its important to sort fact from hype because there is plenty. We have selected some other people's opinions on hype and lies so you can see there are some tall stories floating around.

Jamie Burke CEO & Investor at OutlierVentures.io focused on the convergence thesis: where blockchain is foundational to Web 3.0 a more decentralized and automated future.

How Bitcoins will end world poverty

https://prestonbyrne.com/2017/09/01/the-bear-case-for-crypto/

ICO Initial Coin Offerings

"Cutting to the chase, the reason the ICO and Bitcoin markets are booming the way they are is because regulators in the major jurisdictions for transacting financial business have, for four or five years, more or less entirely abdicated responsibility for enforcing the laws if the word "blockchain" is involved"

Reasons To Be Skeptical

Tech #NewTech MAY 31, 2017 @ 09:29 AM 13,349

Eight Reasons To Be Skeptical About Blockchain

Jason Bloomberg , CONTRIBUTOR

Writes and consult on digital transformation in the enterprise.

- Blockchain is a Solution Looking for a Problem

- End-Users Don't Really Want to Use Blockchain

- Blockchain Will Increase Transaction Costs

- Unlikelihood of Sufficient Adoption

- Blockchain is Too Complicated

- Performance Issues

- Blockchain Ledgers' Immutability Isn't Always a Good Thing

- Blockchain is a 'Trojan Horse,' Sent by Radical Libertarians to Undermine the Global Financial System

Jason Bloomberg is president of industry analyst firm Intellyx .

Don't Trust Anyone

Andreas Antonopoulos at a Blockchain Africa Conference held in Johannesburg says:

"The essence of bitcoin is the ability to operate in a decentralized way without having to trust anyone. The essence ofbitcoin is to be able to use software to authoritatively and independently, without appealing to authority. Verifying everything yourself. You don't trust the other nodes you're talking to. You assume they're lying. You don't trust the miners. You don't trust the people creating the transactions. You don't trust anything other than the outcome of your own verification and validation."

Amazon better watch out

Centralized institutions will fall

Centralized institutions will fall to decentralized software protocols that allow people to do everything peer-to-peer